Some of the worst features of ACA—the individual mandate penalty and Independent Payment Advisory Board (IPAB)—are being relegated to the trash heap of policy failures and states are working to open escape hatches to alternatives outside of DC’s reach.

We celebrate these needed changes; however, additional reform is vitally needed to expand patients’ options for access to high-quality, lower-cost medical care.

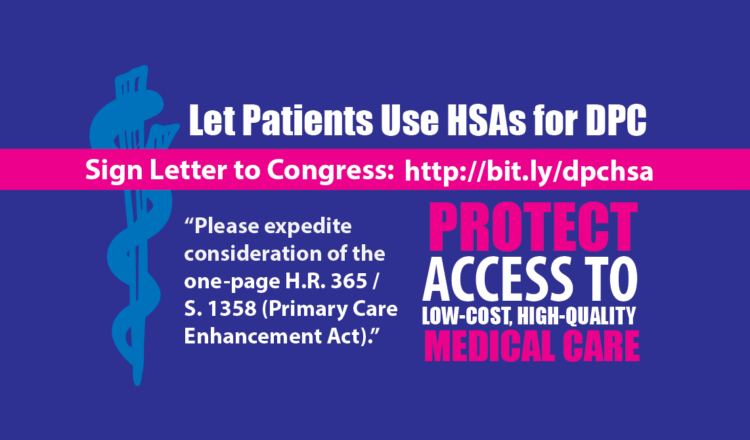

Over the last few months we’ve alerted you about the 1-page Primary Care Enhancement Act (HR 365 / S 1358) that would let patients spend their own HSA funds for Direct Primary Care. Current IRS rules impede individuals with HSAs from even entering into periodic-fee DPC agreements.

Congress has let a couple recent opportunities pass by to enact this simple fix.

It is past time to right this wrong and with your help it will get done!

AAPS Executive Director, Jane M. Orient, M.D. is writing the Senate and House Committees assigned with the legislation asking them to expedite committee approval.

Please stand with Dr. Orient and add your name to our letter and help support a solution to expand patients’ freedom to choose how to spend their own money for medical care.

to add your name to the letters. The text of the letter to the Senate Finance Committee is copied below and you can read by companion letter to House Ways and Means by clicking here.

Thank you for taking time to speak out on this first crucial reform of many that will be needed to re-empower patients and their physicians.

April 18, 2018

Dear Chairman Hatch, Ranking Member Wyden, and Members of the Senate Finance Committee:

We are writing you today to ask you to advance S. 1358/H.R. 365, the Primary Care Enhancement Act of 2017.

This 1-page bill has a simple goal: to allow patients to use their own Health Savings Accounts (HSAs) to pay for Direct Primary Care (DPC) service arrangements. These include all primary-care services, basic diagnostic tests, and commonly used prescription drugs at a package price. The bill clarifies that such arrangements are neither insurance nor health plans as defined in section 223(c) of the Internal Revenue Code and that they are payment for medical care under 213(d) of the code.

The whole purpose of HSAs was to expand patients’ freedom to choose how to spend their own money for medical care. More and more patients, including Medicare beneficiaries, are choosing DPC. They like the up-front, affordable price and the prompt access to a doctor they know and trust. Yet the current IRS interpretation of Internal Revenue Code will not allow patients with HSAs to use their own HSA funds for DPC agreements nor permit them to make tax deductible contributions to their HSA if they have a periodic DPC arrangement.

DPC is lowering costs for both patients and taxpayers. Prescription drugs accounted for $110 billion in Medicare spending in 2015, 17% of all Medicare spending. With DPC dispensing, the cost of pharmaceuticals can be as much as 15 times lower than pharmacy prices. And $17 billion was spent on potentially avoidable hospital readmissions. DPC patients have fewer hospital admissions because of prompt, consistent, personalized care of chronic conditions, and fewer expensive emergency department visits because of 24-hour access to a physician who knows them.

Yet the current IRS interpretation of Internal Revenue Code will not allow patients with HSAs to use their own HSA funds for DPC agreements. It is improper for the IRS to be picking winners and losers in medical financing and care arrangements. It is counterproductive for a tax collection entity to discourage arrangements that save federal dollars while improving medical care.

DPC also addresses the shortage of primary-care physicians by retaining physicians who would otherwise leave primary care practice or the profession altogether owing to “burn-out” from inability to serve their patients well under other practice models.

Please expedite consideration of S. 1358 and, if it cannot advance as a stand-alone measure, look for opportunities to include the language in other upcoming budget bills.

Sincerely,

Jane M. Orient, MD